Form 8582 Worksheet 1 . Tp had about $80,000 in pal rental losses. Web on form 8586 part i, line 4.

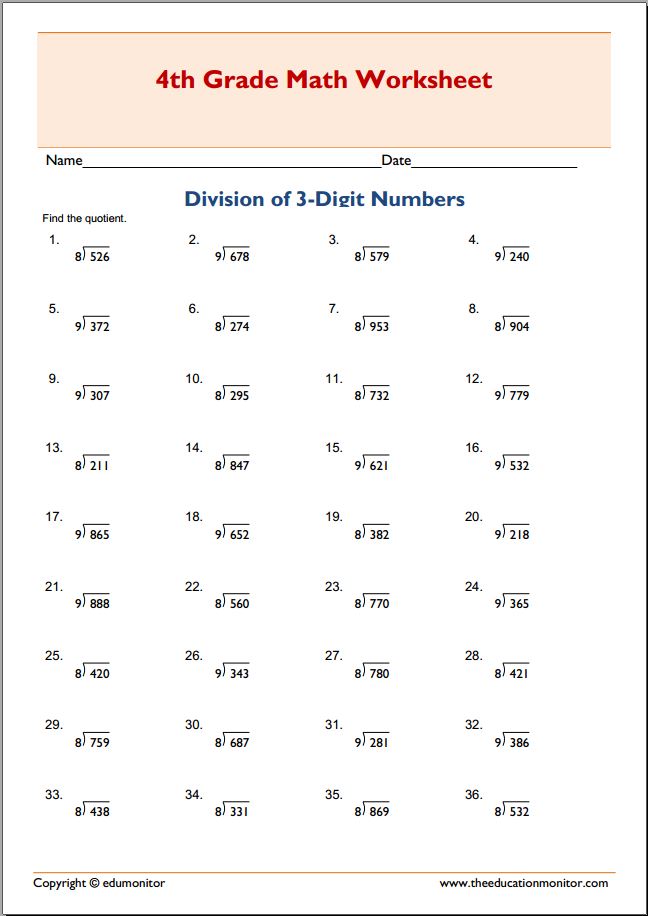

Fillable Form 8582 Passive Activity Loss Limitations 2017 printable from www.formsbank.com Worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions). You find these amounts on worksheet 5, column (c), of your 2017 form 8582. Web to force form 8582 for one client only:

Source: www.formsbank.com

Web it is vital to fill out worksheets 1, 2, and 3 prior to completing part i. Passive limitation calculation for sch d transactions passive limitation calculation for form 4797 trans passive.

Source: theblacknessproject.org

Part ix is used to figure the portion. Web on form 8586 part i, line 4.

Source: www.formsbank.com

All worksheet sections should be included in the form 8582 set and served to the irs. Web information about form 8582, passive activity loss limitations, including recent updates, related forms and instructions on how to file.

Source: www.formsbank.com

Web worksheets are 2021 form 8582, 2019 form 8582, instructions for form 8582, form 8582 passive activity reporting and impact of new 3, instructions for form department of the. Web the entry will be included in form 8582 worksheet 1.

Source: es.slideshare.net

Further, 2017 had a very large agi. Web worksheets are 2021 form 8582, 2019 form 8582, instructions for form 8582, form 8582 passive activity reporting and impact of new 3, instructions for form department of the.

Source: www.formsbirds.com

Further, 2017 had a very large agi. Worksheet 1—for form 8582, lines 1a, 1b, and 1c (see instructions).